A Look at Six Years of Transformative Growth of Group Health Insurance

Over the last six years, the Group Health Insurance segment has experienced significant growth, highlighting the evolving demands of corporate health coverage and the broader insurance market. From FY19 to FY25, the numbers tell a compelling story of transformation in the insurance industry, with Group Health Insurance taking a more significant share of the market.

Market Growth Overview

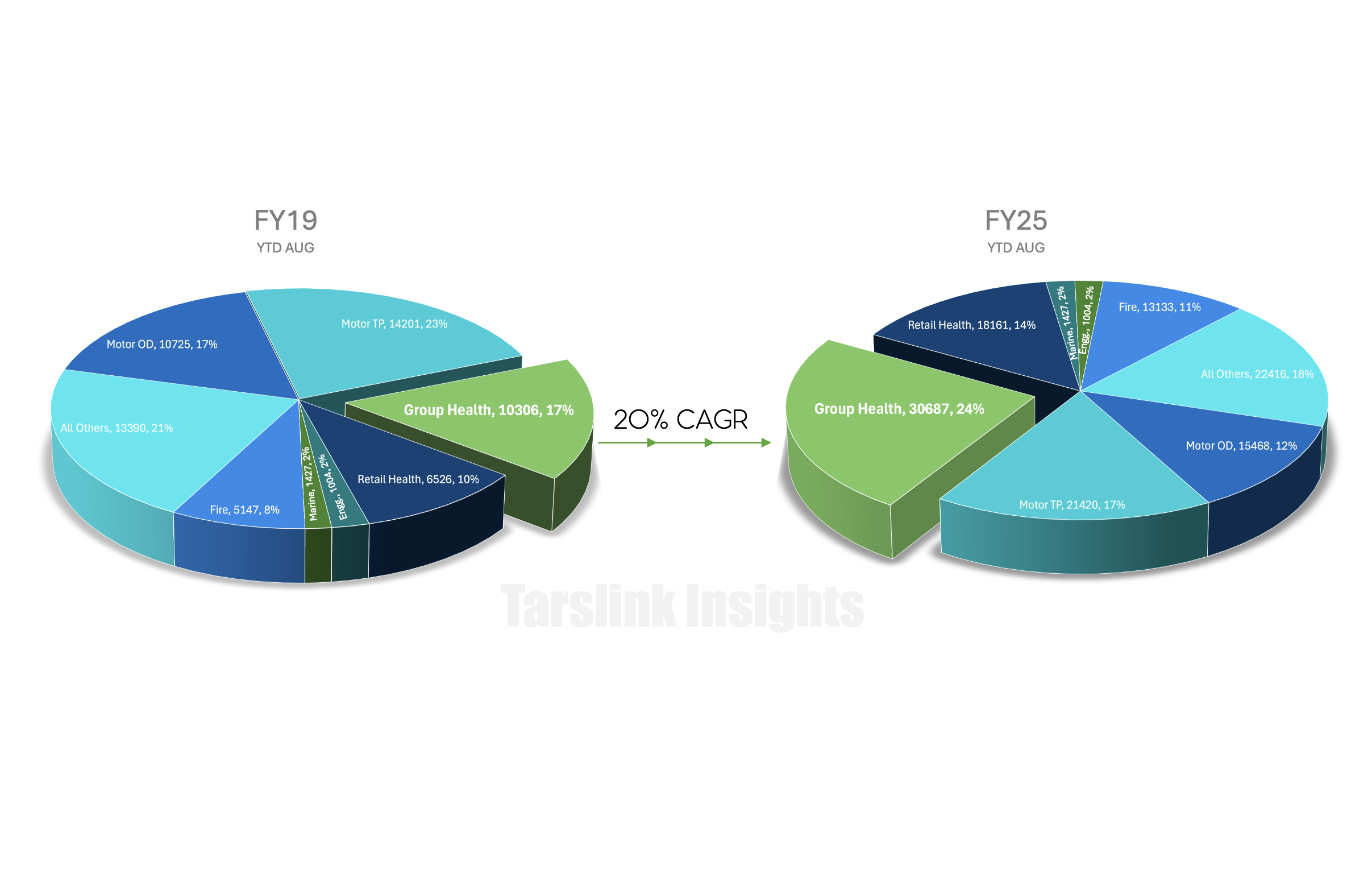

In FY19, the total insurance industry premiums stood at ₹62,726 Crs, with Group Health Insurance contributing ₹9,224 Crs, representing around 15% of the industry. Fast forward to FY25 (YTD August), the industry's total premiums have grown to ₹1,26,345 Crs, with Group Health premiums reaching ₹27,155 Cr. The Group Health Insurance segment's share has expanded to 21% of the market, reflecting a strong compound annual growth rate (CAGR) of 20%, compared to the industry-wide CAGR of 12% during the same period.

What Drives the Growth in Group Health Insurance?

Focus on Employee Well-Being: Corporates have become increasingly aware of the importance of employee health, leading to a rise in demand for Group Health Insurance policies. Employers are now more inclined to offer comprehensive health plans that cater to the diverse needs of their employees.

Customisable Coverage: Group Health Insurance products are designed with flexibility, allowing businesses to tailor coverage according to employee demographics and specific requirements. This customisation has made Group Health Insurance more attractive to employers seeking to provide value-added benefits to their workforce.

Pandemic Impact: The COVID-19 pandemic significantly boosted the need for health coverage, as businesses recognized the value of ensuring that their employees were adequately covered. This demand has persisted, driving further growth in the group health segment.

Digital Innovation: The insurance industry has embraced digital solutions to enhance the policy enrollment, management, and claims experience for corporate clients. Automation, data-driven underwriting, and simplified customer interactions have all contributed to the rising adoption of Group Health Insurance.

The Road Ahead for Group Health Insurance

With the market expected to grow further, here are a few trends that are likely to shape the future of the Group Health Insurance segment:

Increased Personalization: Employers are demanding even more customized health plans. We are likely to see more tailored group health policies that meet the specific health concerns of various workforce demographics.

Focus on Wellness Programs: Beyond traditional insurance coverage, wellness programs focusing on preventive health are becoming increasingly common. Employers are partnering with insurers to offer health incentives, fitness tracking, and regular health check-ups as part of the insurance policy. This trend will continue to shape the Group Health Insurance space.

Tech-Driven Solutions: Digital innovation will continue to drive efficiency and provide seamless experiences. Insurers are now integrating AI, machine learning, and big data to better assess risks, manage claims, and offer more competitive pricing.

Conclusion

The growth of Group Health Insurance from FY19 to FY25 is a clear indicator of the rising awareness and need for comprehensive health coverage at a corporate level. The CAGR of 20% reflects both an increase in demand and an industry-wide shift towards accommodating changing market needs.

For businesses, ensuring employees have access to quality health coverage isn’t just about mitigating risk—it's about investing in the long-term health of the workforce and, consequently, the business itself.