Behavioural Economics in Health Insurance

Health insurance is a critical component of ensuring access to quality healthcare, but getting people to enroll and maintain coverage isn't always straightforward because Health insurance decisions are not purely rational; they are deeply influenced by various psychological factors. People often make decisions that aren't in their best interest, like not enrolling in entitled health insurance. Traditional economics assumes rational decision-making, but it doesn't fully explain these choices. This is where behavioral economics steps in, shedding light on the psychological nuances that influence decision-making. Behavioral economics combines economics with psychology, recognizing that people may not always act rationally in economic terms. It provides a more nuanced toolkit to understand and influence behaviors. Though relatively new in healthcare, it holds great potential to increase coverage and its adherence. In this blog post, we'll explore the concept of behavioral economics in health insurance, its relation to insurance practices, and how it can be harnessed to improve coverage and contribute to the ambitious goal of Universal Health Coverage (UHC).

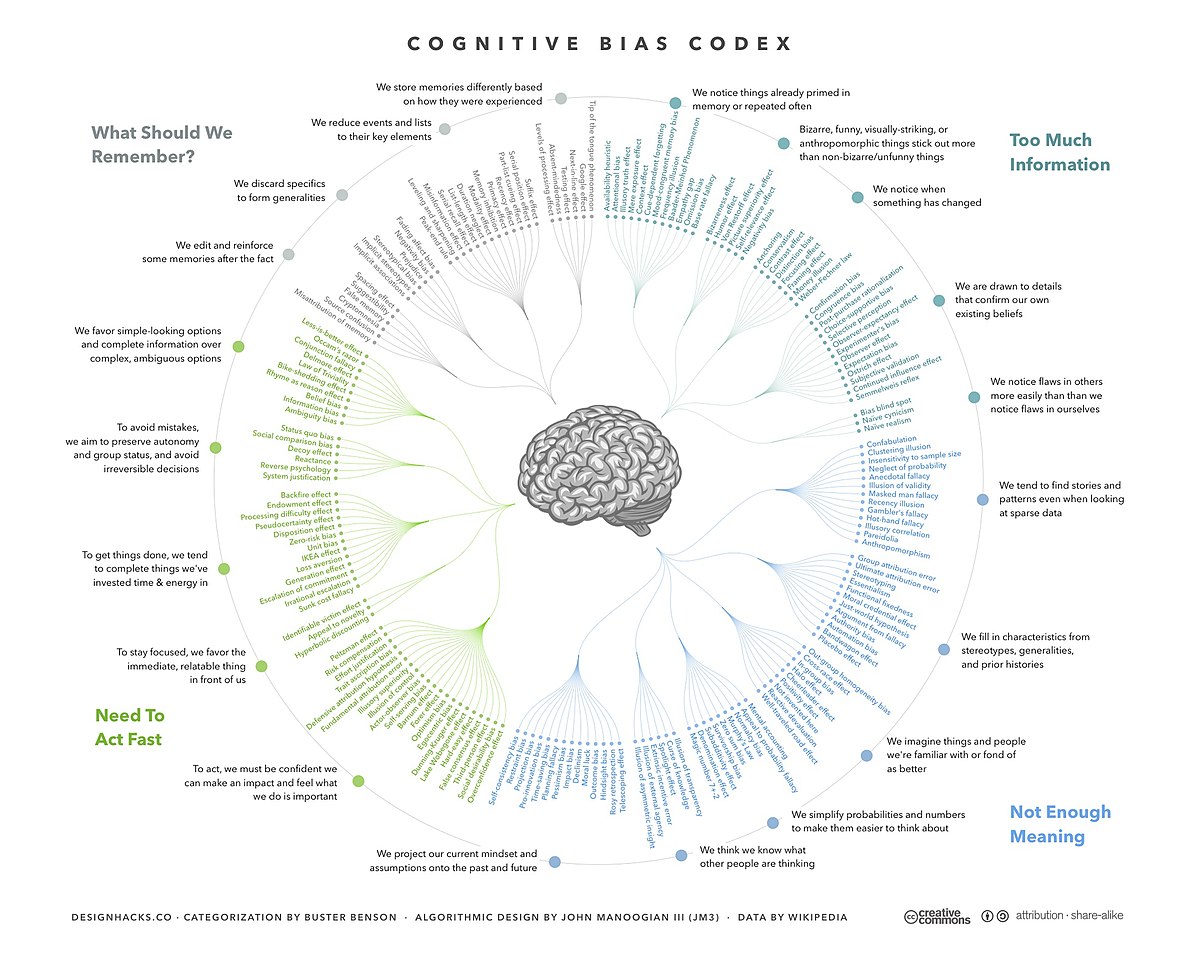

Understanding behavioral economics in health insurance involves recognizing that individuals may not always make decisions based on rational analysis. Cognitive biases, emotions, and simplified decision-making processes, known as heuristics, play pivotal roles in shaping choices.

In the realm of health insurance, people often exhibit what is known as "status quo bias." This is the tendency to stick with their current insurance plans without actively considering alternatives. Additionally, the way information is presented can significantly affect decisions, a phenomenon referred to as "framing effects." These psychological nuances play a crucial role in shaping how individuals perceive and choose their insurance options.

The application of behavioral economics principles can be transformative in encouraging more people to enroll in health insurance. By framing messages to emphasize potential losses from not having coverage and simplifying the enrollment process, insurers can tap into individuals' decision-making patterns and motivate them to take up insurance.

Insurers can strategically use behavioral economics to design insurance products that align better with how people make decisions. Simplifying plan options, reducing complexity during enrollment, and providing clear information about the benefits of insurance can enhance coverage. Introducing behavioral nudges, such as reminders and incentives, can further encourage individuals to maintain their coverage over time.

Looking ahead, the integration of behavioral economics into health insurance holds significant promise for achieving Universal Health Coverage. Future applications could include designing policies and interventions that specifically address behavioral barriers, leveraging technology for personalized communication, and collaborating with behavioral scientists to tailor insurance offerings to diverse preferences.

In conclusion, understanding and leveraging behavioral economics in health insurance is a strategic move in the pursuit of Universal Health Coverage. By acknowledging and addressing the psychological factors that influence decision-making, insurers can not only enhance coverage but also contribute to a healthier and more resilient society. The future of health insurance lies in a thoughtful combination of economic principles and behavioral insights, paving the way for a more inclusive and effective healthcare system.

Image Courtesy: Wikipedia, No copyright infringement intended and has been used purely for impactful contextual illustration